How will PV’s intellectual-property scuffles shake out?

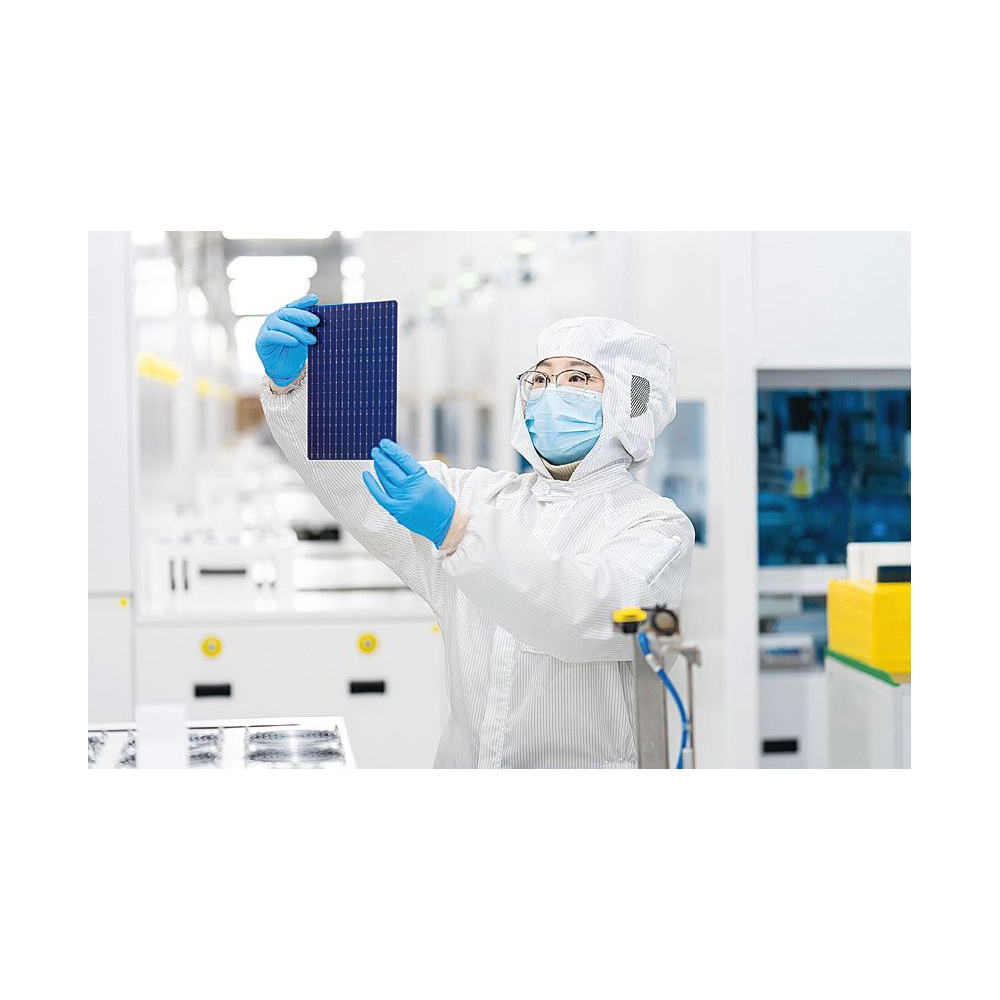

The PV module supply chain marches to a steady beat of progress. Efficiency increases, input cost savings, and throughput improvements deliver cheaper, more powerful products. They are accompanied by an, at times chaotic chorus of rumors, disputes, claims, and counter claims as manufacturers jostle for competitive advantage.

The year 2024 has seen such conflict rise in prominence amid patent infringement investigations and litigation concerning TOPCon solar cell technology. With manufacturers facing intense financial pressure amid rock-bottom pricing, crystalline silicon (c-Si) manufacturers are turning to legal recourse to stay ahead. Somewhat surprisingly, it is not only c-Si manufacturers calling foul on TOPCon.

Intellectual property (IP) disputes are now arising at a point when TOPCon is the dominant technology. After rapid growth, negatively doped, “n-type” TOPCon solar production capacity is surpassing that of the previous PV industry workhorse – positively doped, “p-type” passivated emitter rear cell (PERC) solar, according to UK-based research consultancy Exawatt.

Today’s technology development and price environment may explain the flurry of IP claims. What impact will they have on the wider industry? While IP protection fosters R&D innovation and investment, the uncertainty it sows may have an outsized impact downstream, inflating module prices in some markets and slowing PV deployment. The IP approach taken by Chinese companies in particular is often questioned.

Examining impact

“I can’t help but feeling that, as these cases are launched, pv magazine diligently reports on them but then not very much actually happens,” said Jenny Chase, a solar analyst with BloombergNEF. “Technology in PV moves faster than law so IP disputes don’t have a big market impact.”

There is evidence to suggest that Chase’s take is accurate. In March 2019, Hanwha Qcells and its subsidiaries filed patent infringement complaints in the United States, Germany, and Australia related to the passivation technology it deployed in PERC solar production. The claims were leveled against JinkoSolar, Longi Solar, and REC.

There were wins and losses for Qcells, plus an REC counter claim about module technology in the United States. By the time the cases had progressed through the courts, the switch to TOPCon was already underway. Qcells withdrew from Australia in 2024.

The current TOPCon patent conflicts are shaping up to be more disruptive. The technology is in the ascendancy but it’s doubtful anything meaningful will arise from the suits and an unexpected entrant has now joined the fray.

Thin pickings

In July 2024, First Solar announced that it had started investigating whether TOPCon intellectual property it acquired in 2013 is now being unlawfully deployed. First Solar acquired a number of patents when it purchased California-based crystalline silicon startup TetraSun. Investigation tends to precede action in patent claims.

At the time of the acquisition, now-shuttered website Greentech Media reported TetraSun was “a 14-employee startup with $12 million from investors and little more than a pilot cell manufacturing plant.” First Solar had indicated it would commence commercial production of the technology in the second half of 2014.

The technology being developed was not identified but featured attributes common to n-type TOPCon – notably a -0.3% temperature coefficient, according to a preliminary datasheet. TetraSun was also attempting copper metallization, something which largely evades today’s manufacturers.

Announcing the IP investigation, First Solar General Counsel Jason Dymbort said the thin-film manufacturer’s “R&D and intellectual property portfolio spans several semiconductor platforms, including crystalline silicon, as we pursue multiple pathways towards our goal of developing the next transformative, disruptive solar technology.”

First Solar wound up its TetraSun program in July 2016. It did not make a spokesperson available to pv magazine for comment on the IP suit.

“Patents are important to provide a good return on investment to inventors and innovative companies,” said Pierre Verlinden, former chief scientist at Chinese giant Trina Solar and now an independent solar manufacturing consultant. He added, the TetraSun patent investigation might enable the manufacturer to use IP to “attack their competitors manufacturing silicon TOPCon cells.”

Balancing act

Verlinden acknowledged PV patent disputes represent a somewhat “difficult issue” for him. As a former director at German perovskite-tandem developer Oxford PV and a technology executive at Trina Solar, he has familiarity with the Chinese and Western solar industries.

“From an idealistic point of view, I would like to see more collaboration on technology at the global level, from research institutions and industry, and let the competition happen at the execution level,” said Verlinden. “This has effectively happened for years in China with more informal exchanges between companies and standardization of process, design, and supply chain.” That results in winners based on execution and “an accelerated learning curve” for the industry.

Chinese manufacturers are joining the TOPCon patents fray. In April 2024, Singapore-headquartered n-type producer Maxeon, which manufactures in China, announced a TOPCon patent infringement lawsuit in the United States against Qcells, following similar action a month earlier against Canadian Solar and REC.

JA Solar told pv magazine, in August 2024, that it has filed two cases in Europe over aspects of TOPCon production. A month prior, Trina Solar said it was investigating whether its TOPCon patents had been infringed. A Trina spokesperson said the company hoped a licensing agreement, or other recourse, could avoid going to court. Trina had reached a TOPCon licensing agreement with Qcells in February 2024.

China IP

Lodging claims in the United States and Europe has relevance. Defending “artificially high prices” for solar in the United States has value for First Solar, Qcells, and to a lesser extent Maxeon, according to BloombergNEF’s Chase, who added, “First Solar is good at manufacturing, at being a solar company but also good at being lawyers.”

PV module average selling prices (ASPs) in China hit $0.11/W in July 2024, according to China solar expert Frank Haugwitz, a consultant with Apricum. Investment bank Roth Capital estimates second-quarter 2024 ASPs in the United States will be around $0.31/W.

Movement of staff between companies ensures knowledge transfer is common in Chinese solar, according to Chase, enabling the industry “to innovate so quickly, which is probably a good thing.”

While there is plenty of homegrown innovation in Chinese solar manufacturing today, companies were accused of not respecting IP in the early stages of the industry’s development there.

Torsten Brammer was the co-founder and long-serving chief executive of LED-based metrology equipment provider Wavelabs. He said that intellectual property can be effectively safeguarded in China, with the right strategy.

“If you have a smart idea, I encourage you to file for patents in China,” said Brammer. “I’ve had positive experiences with the Chinese patent system but it’s crucial to have a local IP expert guide you through the process.” He noted many “cross-licensing agreements” in place in the industry, which are not generally made public. “Keep in mind that the Chinese industry is eager to adopt the best solutions, so making your patented innovation available and considering collaboration can lead to a faster rollout and overall broader business success.”

While TOPCon is moving into the mainstream, and heterojunction is waiting in the wings, perovskite tandem tech looks set to bring the next generation of high-efficiency PV. Oxford PV has long been a leader in perovskite tandem development, as shown by the 26.9%-efficient module it unveiled in June. Yet it faces fierce competition from Chinese rivals.

The company’s chief technology officer, Chris Case, takes a somewhat philosophical approach to IP. “Competition is a kind of flattery – if people are copying what you are doing, they are doing so because it’s a good idea,” he said.

Popular content