Middle East, Southeast Asia wafer makers ramp capacity amid record-low prices

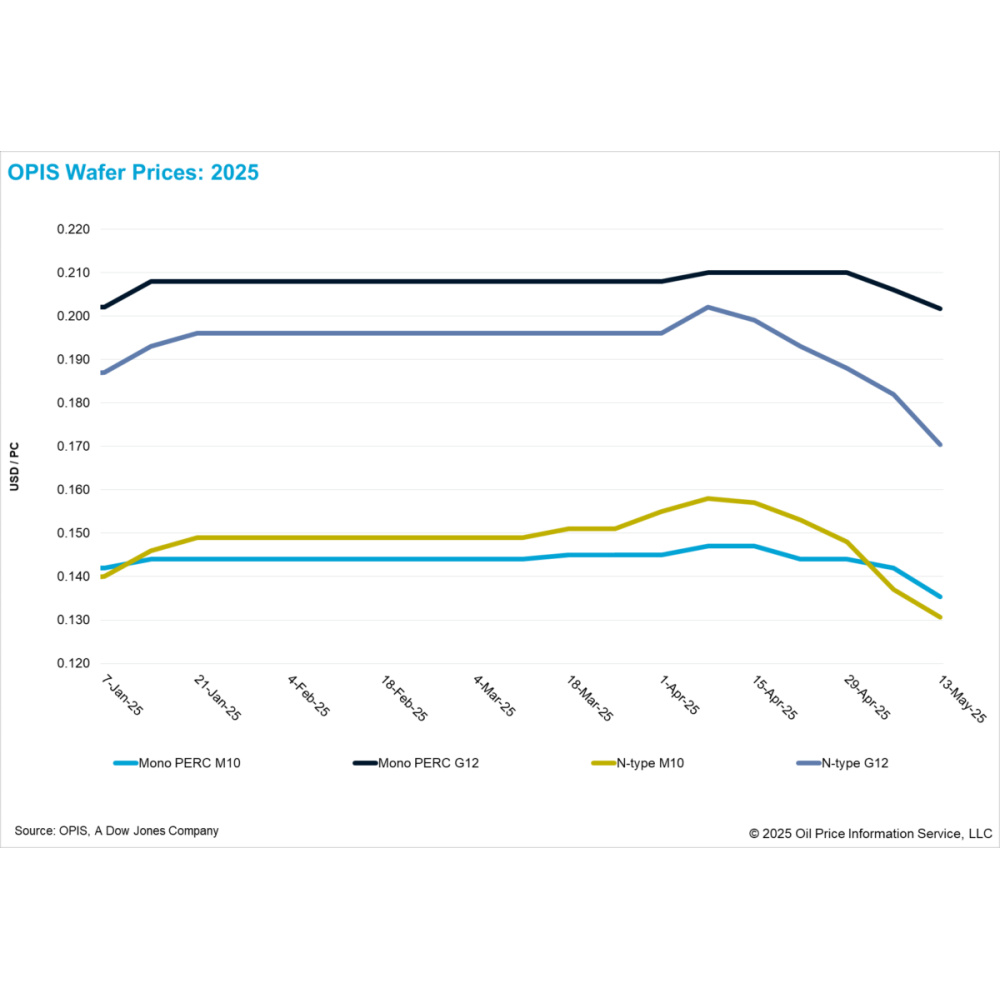

FOB China wafer prices saw broad-based declines this week. Mono PERC M10 and G12 wafer prices decreased to $0.135/pc (per piece) and $0.202/pc, representing week-on-week drops of 4.93% and 1.94%, respectively. Likewise, N-type M10 and G12 wafer prices fell to $0.131/pc and $0.170/pc, down 4.38% and 6.59% from the previous week.

The notable decline in wafer prices is largely driven by weakening downstream demand following a recent peak. Market sources indicate that both solar cell and module producers plan to reduce operating rates starting in May, with wafer manufacturers reportedly following suit.

According to insiders, specialized wafer manufacturers are maintaining relatively higher utilization rates, with one leading player reportedly operating at around 80% capacity. In contrast, integrated manufacturers have reduced their utilization to approximately 55%, while smaller second- and third-tier producers, constrained by limited capacity and outdated equipment, are running at just 20% to 30%.

Although current wafer inventories remain manageable, weakening demand combined with persistent overcapacity has heightened the risk of inventory accumulation. In response, some wafer manufacturers have begun reducing prices and are sacrificing profit margins in an effort to stimulate sales, according to trade sources. The prevailing transaction price for mainstream N-type M10 and 182*183 mm wafers in the Chinese market reportedly hovers around CNY 1 ($0.14)/pc, with certain 182*183 mm wafers already trading below this threshold. Industry sources report that some cell manufacturers are insisting on a maximum wafer procurement price of CNY 1/pc.

Concerns are mounting over the future profitability of wafer manufacturers. One market observer noted that, under ideal conditions – full production capacity and access to N-type polysilicon priced below CNY 30/kg – the cash production cost for N-type M10 wafers could be limited to around CNY 1/pc. However, with current N-type polysilicon prices remaining in the higher range of CNY 30/kg to CNY 40/kg, and wafer production lines operating below optimal levels, financial losses across the sector are becoming increasingly apparent.

Looking ahead, widespread pessimism surrounding market demand in 2025 is deepening bearish sentiment regarding the profitability outlook for Chinese wafer producers. Industry insiders point out that, due to the sector’s vast capacity and high operational flexibility, any meaningful capacity reduction will likely be a prolonged process. In the interim, the ability to maintain sufficient cash flow will be critical for determining whether companies can endure in the long term.

In the global market, operational trends among wafer manufacturers outside China are showing mixed developments. A Southeast Asian wafer producer with an estimated capacity of 6 GW is reportedly increasing its operating rate from below 50% to over 70% in May, driven by the rapid expansion of cell manufacturing facilities in Indonesia. In contrast, another Southeast Asian wafer manufacturer of similar capacity is said to be maintaining a relatively low utilization rate of around 30%.

Meanwhile, a company that has announced large-scale wafer manufacturing plans in the Middle East is reportedly preparing to commence construction as early as the first or second quarter of next year. However, a source familiar with the matter noted that the company is still assessing the economic feasibility of the project, raising the possibility of further delays.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.